All Categories

Featured

In 2020, an approximated 13.6 million united state homes are certified investors. These families regulate huge riches, estimated at over $73 trillion, which stands for over 76% of all personal riches in the united state. These financiers participate in financial investment possibilities normally not available to non-accredited financiers, such as investments secretive firms and offerings by certain hedge funds, personal equity funds, and venture capital funds, which allow them to expand their wide range.

Review on for information regarding the most up to date accredited capitalist alterations. Funding is the fuel that runs the financial engine of any type of country. Financial institutions generally fund the majority, but rarely all, of the capital needed of any type of acquisition. Then there are scenarios like startups, where banks do not offer any type of financing whatsoever, as they are unproven and considered dangerous, however the requirement for resources continues to be.

There are mainly 2 policies that permit companies of safeties to provide endless quantities of protections to investors. new rules for accredited investors. Among them is Rule 506(b) of Regulation D, which enables a company to sell safety and securities to limitless recognized financiers and as much as 35 Sophisticated Investors just if the offering is NOT made with basic solicitation and general advertising

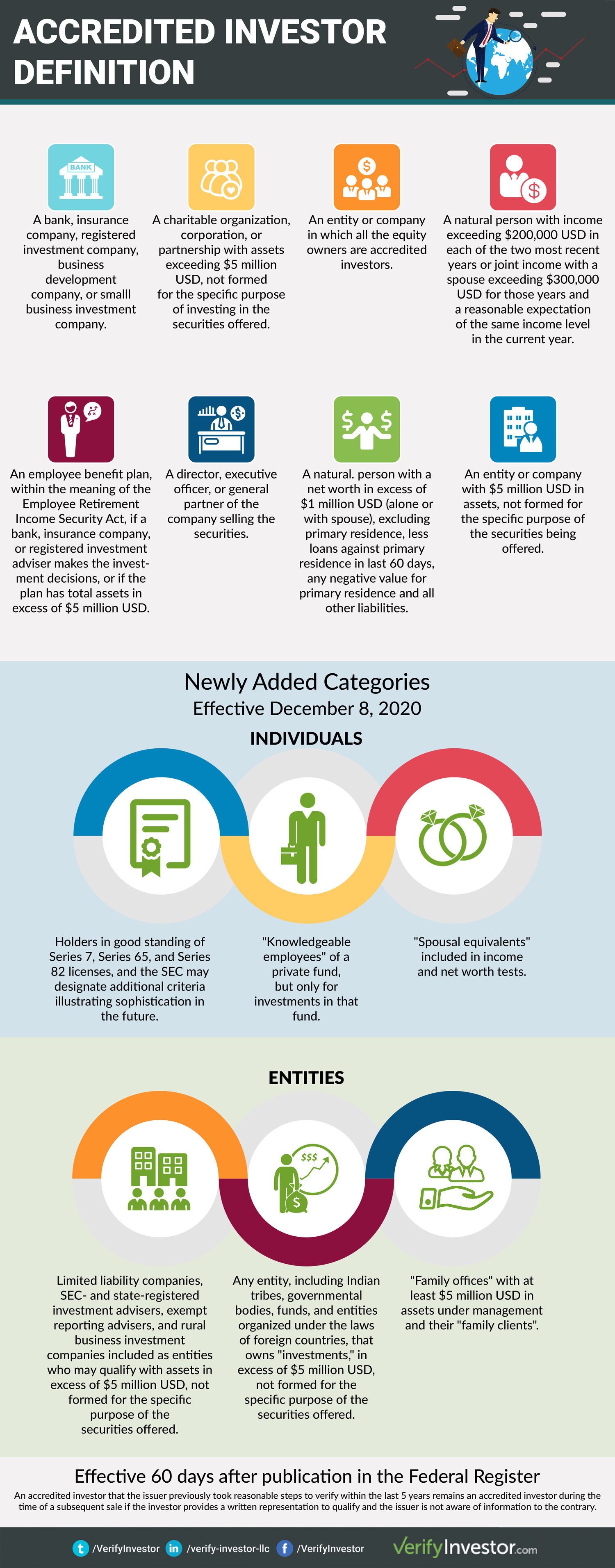

The freshly embraced changes for the very first time accredit private investors based on economic sophistication needs. The changes to the recognized capitalist interpretation in Guideline 501(a): include as certified financiers any depend on, with complete possessions much more than $5 million, not formed specifically to acquire the subject protections, whose purchase is guided by a sophisticated individual, or include as certified capitalists any type of entity in which all the equity proprietors are recognized capitalists.

And since you know what it suggests, see 4 Realty Marketing approaches to bring in accredited financiers. Internet Site DQYDJ Short ArticleInvestor.govSEC Proposed modifications to meaning of Accredited InvestorSEC modernizes the Accredited Capitalist Meaning. Under the federal securities laws, a company might not supply or market securities to investors without enrollment with the SEC. However, there are a number of registration exemptions that inevitably broaden deep space of potential capitalists. Many exceptions call for that the investment offering be made just to persons who are accredited financiers.

Additionally, certified capitalists frequently obtain more desirable terms and higher possible returns than what is available to the general public. This is since personal positionings and hedge funds are not called for to adhere to the very same regulative needs as public offerings, permitting even more adaptability in regards to investment strategies and prospective returns.

Accredited Investor Ipo

One reason these protection offerings are restricted to certified capitalists is to ensure that all participating capitalists are economically advanced and able to fend for themselves or sustain the threat of loss, hence rendering unneeded the securities that come from a licensed offering.

The net worth examination is relatively simple. Either you have a million bucks, or you do not. On the revenue test, the person should satisfy the thresholds for the three years continually either alone or with a partner, and can not, for example, satisfy one year based on private earnings and the following 2 years based on joint earnings with a spouse.

Latest Posts

Homes For Sale For Back Taxes

What Are Tax Foreclosures

Unpaid Tax Property